Kenya's favoured Murban oil prices rise above KSh 9k per barrel as Israel-Iran war escalates

Escalating hostilities between Israel and Iran have sent global oil markets into a tailspin.

Prices of oil have risen significantly in recent weeks due to fears of supply disruptions.

Iran wields considerable influence over Middle East oil shipments due to its strategic position near the Strait of Hormuz, a key global oil chokepoint through which a significant portion of the world’s crude passes.

Its proximity and partial control over this narrow passage grants Tehran powerful leverage. According to the International Energy Agency (IEA), any real or perceived disruption to the strait triggers a spike in oil prices.

IEA said that it is monitoring the impact of the Israel-Iran war on the oil markets and noted that although physical supply remains largely intact, even the perception of danger in the Gulf can fuel speculative rallies, squeezing refiners and consumers alike.

What are the global oil prices

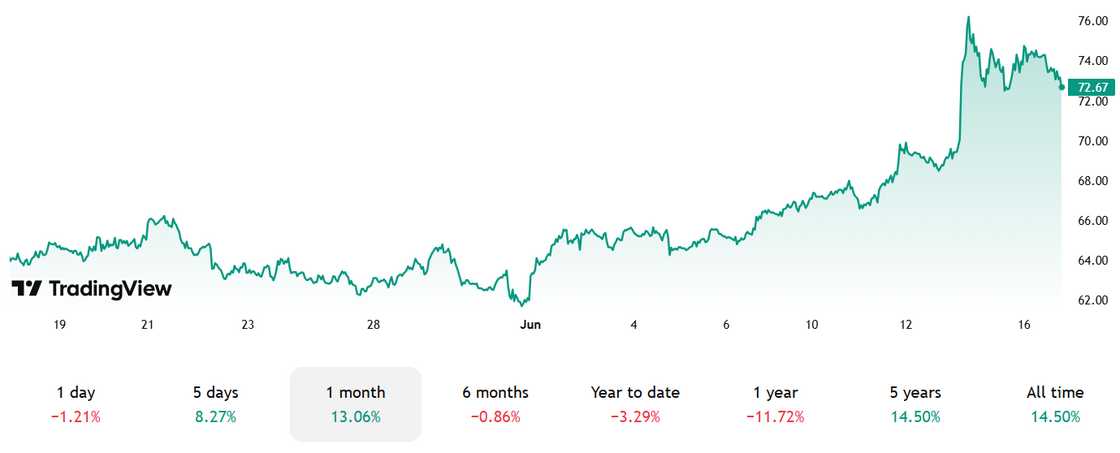

On Monday, Brent crude surged to $74.87 (about KSh 9,600) per barrel, while U.S. West Texas Intermediate rose to $73.74 (about KSh 9,700) per barrel. One barrel of crude oil contains 159 litres.

Abu Dhabi’s Murban Crude Oil, a key Asian benchmark, also climbed sharply and settled above $70 (about KSh 9,000) per barrel on June 16, up from the lows of $61 (about KSh 7,800) per barrel recorded in early June.

What is the impact in Kenya?

Kenya imports its petroleum products (super petrol, diesel, and kerosene) from the Middle East, with prices based on the Murban Crude Oil benchmarks.

Speaking to .co.ke, Daniel Kathali, an economist, noted that if the prices remain unchecked, Kenyans should brace for a rise in the cost of petroleum products.

"The impact of the rise in global oil prices will definitely be felt in Kenya because we import all the petroleum products. The rise will increase the landed cost of petroleum products in Kenya, and this rise will have to be calculated into the prices by EPRA (Energy and Petroleum Regulatory Authority)," Kathali opined.

He further warned that the rise in oil prices often has ripple economic effects which lead to higher prices for other products.

"The rise of petroleum products in the country could lead to high inflation rates. This is because the rise in the prices of petroleum products leads to an increase in production and logistical expenses which are passed on to consumers," he opined.

Posting Komentar untuk "Kenya's favoured Murban oil prices rise above KSh 9k per barrel as Israel-Iran war escalates"

Posting Komentar