Hong Kong’s US-dollar peg a key success factor and will stay: John Lee

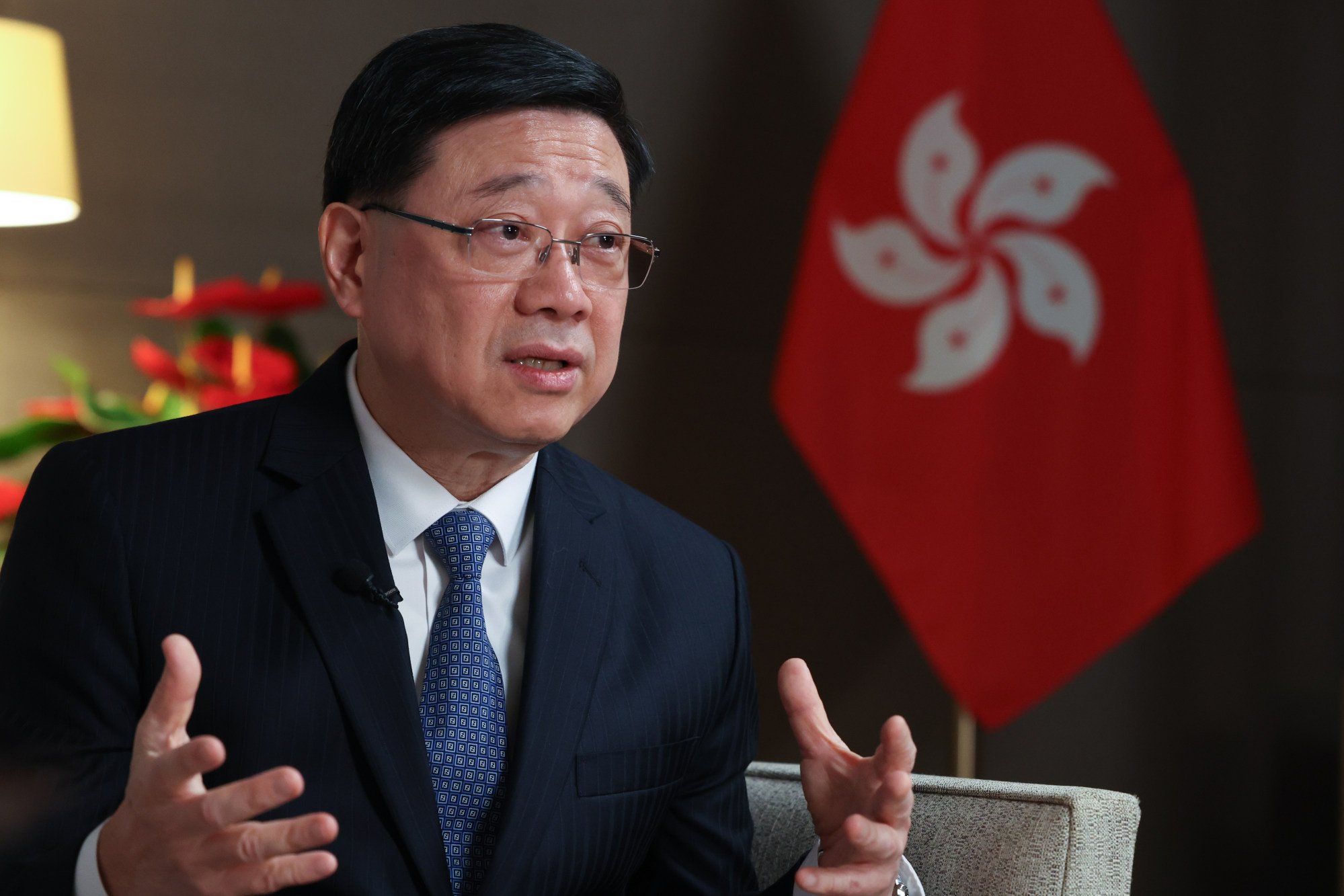

Hong Kong will maintain its currency's peg to the US dollar, the city's leader has said, identifying it as a key success factor and rejecting calls to abandon the link amid escalating geopolitical tensions.

But this did not mean the city was solely reliant on the peg for its financial system, and Chief Executive John Lee Ka-chiu pledged to strengthen Hong Kong's dominant role as a global offshore renminbi business centre, promising more product diversification.

Lee's reassurance came after multiple interventions by the city's de facto central bank recently to defend the peg as the Hong Kong dollar hit the higher end of its trading band, triggered by equity investment activities and the appreciation of regional currencies against the US dollar.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge , our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

"Hong Kong's link with the US dollar has proven to be one of the fundamental success factors," he told the Post in an interview, noting the peg had always come under pressure, especially in uncertain times.

In a series of interventions last month, the Hong Kong Monetary Authority (HKMA) spent HK$129.4 billion to buy US$16.7 billion worth of US dollars to weaken the local currency, which had hit the strong end of its trading band.

The move came amid a wave of capital inflows, driven by increased investor interest in Hong Kong stocks and steady southbound buying from mainland Chinese investors via the Stock Connect mechanism.

The city's currency has been pegged to the US dollar since 1983. Under the current system, in place since 2005, the HKMA intervenes to maintain the currency within a narrow band of HK$7.75 to HK$7.85 per US dollar.

As US interest rates continue to remain high, debate has been simmering on whether the peg is still suitable, given Hong Kong's sluggish property market.

Some critics had also expressed concerns about the outlook for the peg amid the festering tensions between China and the United States under Donald Trump's leadership, with some calling for pegging the Hong Kong dollar to the yuan instead to reflect the city's ties with the mainland.

While defending the US-Hong Kong dollar peg, Lee also said his administration would strengthen the city's role as the global offshore renminbi hub.

"We will do more product diversification, so that it will generate more trade," he said, noting that about 80 per cent of the world's offshore renminbi payments were processed in the city.

Lee said he hoped the city could provide more products so that it would become a place that could create extra earnings for overseas investors with renminbi in hand.

He pointed to the dual-counter trading model, which allows investors to use offshore yuan funds to buy yuan-denominated shares listed on the Hong Kong stock exchange.

"We'll work hard to see how we can even strengthen it," he said.

Hong Kong was also in the midst of "working hard" on digital currencies, referring to the HKMA's efforts to pilot a central bank digital currency for public use.

Regarding Hong Kong's new Stablecoins Ordinance passed last month, Lee described it as part of the "blue oceans" strategy to chart new areas of growth for the city.

A stablecoin is a type of cryptocurrency backed by a reference asset, usually fiat currencies such as the US and Hong Kong dollars.

"I also think we are at the forefront in this," he said.

The new ordinance, which is set to take effect on August 1, requires issuers of stablecoins to be licensed.

More Articles from SCMP

As US door shuts, Brazilian one opens

Critically injured Hong Kong officer ‘did what he needed to do’: police chief

South China Sea: Beijing’s 4 core principles held up as route to peace in disputed waters

Britney Wong doubles up again at Sha Tin as Cheval Valiant leads them a merry dance

This article originally appeared on the South China Morning Post (www.scmp.com), the leading news media reporting on China and Asia.

Copyright (c) 2025. South China Morning Post Publishers Ltd. All rights reserved.

Posting Komentar untuk "Hong Kong’s US-dollar peg a key success factor and will stay: John Lee"

Posting Komentar